Homeownership FAQ's

Frequently Asked Questions

Becoming a Homeowner FAQ’s

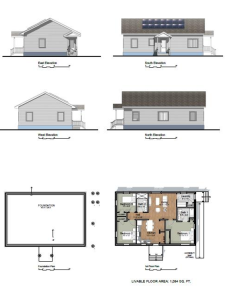

What is a typical Habitat home like?

Habitat homes are simple, decent, energy-efficient and affordable with approx. 900 to 1,200 square feet of living area (depending on the number of bedrooms).

I am homeless or about to become so. Can Habitat help me?

No, our program is a long-term solution, not a quick fix. Resources for immediate housing needs are available at the Mass211 website or by telephoning 211. Our program can be a long-term solution after you address your current housing situation.

How much does a Habitat for Humanity home cost?

A typical Habitat home in north central Massachusetts costs between $160,000 and $190,000.

How much will my mortgage payment be?

Habitat for Humanity NCM’s mortgage payments are affordable, around 30% of your monthly gross income. In some cases, your mortgage payment may be less than your current rent.

How long is the homebuying process from start to finish?

The amount of time from selection to homeownership is normally 6-18 months. During this time you will be working on your “sweat equity” hours, attending homeowner education classes and saving for a down payment.

My credit's not perfect. Should I still apply?

Yes. Having less than perfect credit will not necessary disqualify you. We look at your whole financial picture.

Do I have to pay a downpayment?

Like anyone purchasing a home, Habitat partner families are required to make a downpayment of a minimum 1% of the final cost of the home.

What if I've declared bankruptcy at some point? Will that stop me from qualifying?

It depends. If the bankruptcy has been discharged and you have lived a financially balanced life since, there may be no problem. However, a brand new bankruptcy with no new financial history can be difficult. Our family selection committee will ask you about it so please be prepared to provide all necessary information.

Who decides which families get to buy homes?

Habitat for Humanity North Central Massachusetts has a Family Selection Committee comprised of community volunteers. Working with the HFHNCM Executive Director, QLO and Family Services Manager, they accept applications, review income and expenses, evaluate credit reports and meet with all potential applicants. Qualified applicants are then entered in to a public lottery.

Homeowner applicants are qualified without regard to age, sex, sexual preference, marital status, disability, race, religion or national origin.

How will I know if I'm chosen or not?

All applicants will receive a letter stating whether they were accepted or denied. The denial letter will clearly state why they were not chosen with suggestions for what they can do to better their chances of being chosen if they apply again in the future.

If I'm not selected, can I reapply?

Yes.

Can I be de-selected?

Families can be de-selected for the following reasons:

• if it is discovered that an applicant has not been truthful in any way on any part of the application,

• if the applicant has shown an unwillingness to partner with Habitat for Humanity (not performing sweat equity or getting the down payment ready, etc.),

• if there has been a negative change in the applicant’s economic circumstances (affecting their ability to pay the monthly mortgage payment for the foreseeable future).

• if it is discovered that an applicant has not been truthful in any way on any part of the application,

• if the applicant has shown an unwillingness to partner with Habitat for Humanity (not performing sweat equity or getting the down payment ready, etc.),

• if there has been a negative change in the applicant’s economic circumstances (affecting their ability to pay the monthly mortgage payment for the foreseeable future).

If I sell my Habitat home, can I make a profit?

Habitat for Humanity North Central Massachusetts places deed restrictions on the homes it sells limiting the homeowner’s ability to sell, lease, refinance, encumber or mortgage the property. That limits the equity a homeowner may realize in the event of a sale.

Still have questions?

Contact Jessica Rodriguez-Ortiz, HOME & Family Services Coordinator (978) 348-2749

or send us an email.

Get Notified

Request to be notified of the next homeownership opportunities in the North Central Massachusetts area.